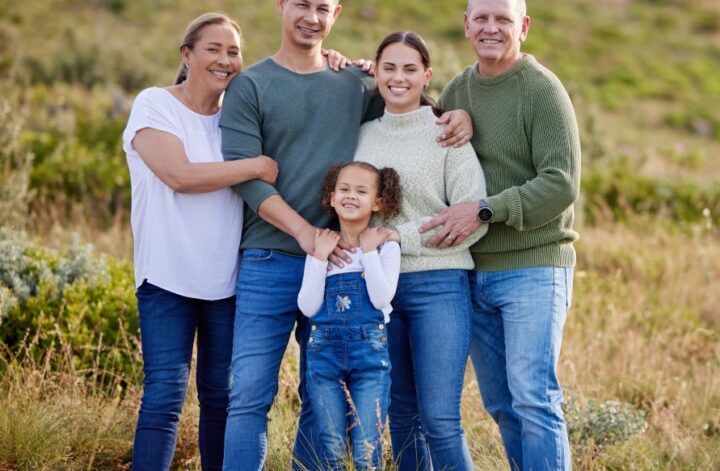

Would you like to send it to your family in Canada? Consider Super Visa, a remarkable program by Parent Super Visa designed to bring families together and create lasting memories. In this blog, we delve into the world of Canada’s Super Visa, examining new avenues for family reunification and long-term visits.

In this article, we will walk you through the Super Visa eligibility criteria, the key features, and any financial requirements that may arise. We’ll also go over the advantages of Parent Super Visa Insurance and why is it necessary to have one.

What is a Super visa?

The Super Visa is an excellent benefit for extended family visits. Individuals who are eligible, such as parents or grandparents of Canadian citizens or permanent residents, can apply for a Super Visa, which allows them to stay in Canada for up to two years without the need for frequent visa renewals. This allows families to spend more time together, creating precious memories and strengthening bonds without the hassle of multiple visa applications.

The Super Visa provides long-term support to families who want to stay together and spend quality time together. It enables more expansive experiences, such as witnessing the value of family, providing support during life transitions, or enjoying long-term bonding. Families can avoid the hassle of renewing their visas by opting for a Super Visa.

Eligibility Criteria for Super Visa

To be eligible, you must meet the following criteria:

- Applicant should be parent or grandparent of a Canadian citizen or permanent resident

- It is necessary to have a written invitation from a Canadian citizen or permanent resident.

- The child or grandchild must prove that they fulfill the minimum income requirement.

- Valid private health insurance coverage from a Canadian insurer i.e. Parent super visa insurance is required for at least one year.

- To ensure your health and entry into Canada, you must have a medical examination performed by an approved physician.

What is Super Visa Insurance?

Applicants for a Super Visa must have private health insurance while in Canada. This section emphasizes the significance of Super Visa coverage and describes the coverage requirements. It also offers guidance on selecting the right insurance plan, including coverage limits, medical conditions, and other considerations for the well-being and safety of visiting family members.

There are numerous factors to consider when selecting the best insurance plan for a Super Visa i.e. Parent super visa insurance program. Coverage limits, deductibles, pre-existing medical conditions, medical emergencies, and duration of coverage are all examples. It is critical that you carefully read the policy terms and ensure that they meet the requirements for the Super Visa program.

Visitors should seek out an insurance plan that offers comprehensive coverage for medical services, hospital stays, and emergency medical care. Parent super visa insurance is giving you 3 plans. Pre-existing medical conditions should also be disclosed to ensure adequate coverage and avoid potential questions. Comparing various insurance providers and obtaining quotes can assist individuals in making the best decision and locating a plan that meets their needs and budget. You can get a quote using the parent super visa insurance calculator on the home page.

Visiting family members can be easy knowing that they are covered in the event of a medical emergency by purchasing the necessary Super Visa insurance. This insurance improves their well-being and security while in Canada, allowing them to focus on spending quality time with their loved ones without worrying about the financial consequences of unexpected medical conditions.

The Game-Changing Benefits for Families

Now that we’ve established the significance of parent super visa insurance, let’s look at the game-changing advantages for families:

1. Facilitates Family Reunions

A parent and grandparent super visa allows families to be reunited for a longer period, which is one of its main benefits. This experience is enhanced by parent super visa insurance, which ensures that older family members receive medical care and support during their stay.

2. Eases the Visa Application Process

It can be difficult to navigate the Canadian immigration system. Parent super visa insurance makes the process easier by assisting families in meeting insurance requirements. Because insurance is required as part of the application process, this greatly increases your chances of getting a super visa.

3. Protects Families from Financial Strain

Medical emergencies can be financially draining, and no family wants to see their loved ones suffer because they do not have enough money. Parent super visa insurance provides critical financial security, relieving families of the burden of unexpected medical expenses.

4. Maintains health and well-being

The health and well-being of visiting parents and grandparents are critical to their Canadian relatives. Parent super visa insurance ensures that elderly relatives receive quality health care and that their visits are comfortable and safe.

5. Peace of Mind

Knowing that their parents or grandparents are insured provides peace of mind to the family they support. This sense of security enables families to fully enjoy their time together without being concerned about health issues.

Conclusion

Parent super visa insurance is a game changer for families because it expands the benefits of the parent and grandparent super visa program. It ensures that elderly parents and grandparents have full medical coverage, that visa requirements are met, that financial security is provided, and that families have peace of mind as they reunite. The ability to reconnect with long-distance family members is a welcome opportunity that Canada is providing. The Parent super visa insurance makes this experience safer and more enjoyable. It demonstrates Canada’s dedication to family unity and the well-being of its immigrant communities.

Parent Super Visa Insurance is indeed a game changer for families, as it enhances the benefits of the Parent and Grandparent Super Visa program. It ensures that elderly parents and grandparents have access to comprehensive medical coverage, fulfills the visa requirement, provides financial protection, and offers peace of mind to families during their reunions. The ability to reunite with family members for extended periods is a cherished opportunity, and Parent Super Visa Insurance makes this experience safer and more enjoyable. It’s a testament to Canada’s commitment to family reunification and the well-being of its immigrant communities.

Related Blog – Latest Updates in Parent Super Visa Insurance Regulations: Stay Informed