Introduction

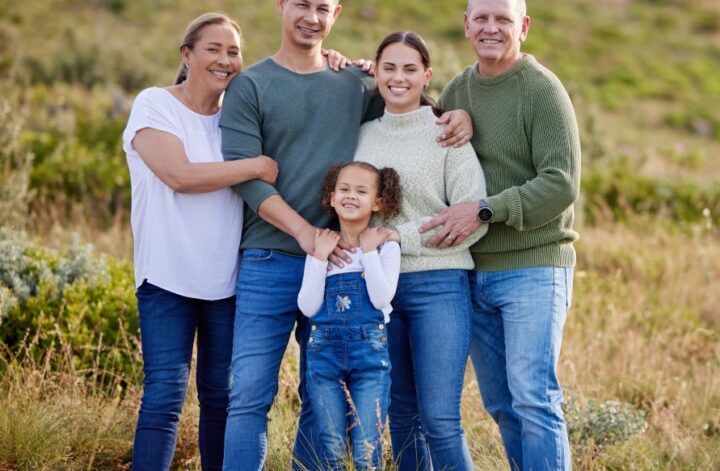

The Canadian Super Visa program has been gaining popularity lately thus many families are opting to take super visa insurance monthly plans for their relatives, to get a comprehensive cover on them whilst they stay in Canada. But, it is a challenging task when it comes to understanding the complexities of these schemes, especially selecting the right deductible. This article intends to give useful insights and hints that can assist you come up with an appropriate choice and discover your perfect super visa insurance monthly plan.

Understanding Deductibles

Before examining the tips, it is important to grasp what is meant by a deductible within the context of super visa insurance monthly plans. Your deductible stands for the sum that you will have to spend out of your pocket before your insurance coverage starts. It is an essential point that directly influences your premium every month and what you eventually wind up spending on your super visa insurance monthly plan.

Balancing Premiums and Deductibles

In relation to a super visa insurance monthly plan, there exists an inverse relationship between its premiums and deductibles. The general rule here is such that higher deductibles result in lower premiums on a monthly basis while lower ones result in higher premiums per month. Striking this delicate balance is very crucial so that you do not end up underinsured or overpaying.

Assessing Your Financial Situation

Before you decide on what amount should be deductible for your super visa insurance monthly plan, it’s necessary to make a critical study of one’s financial position. Consider how much money you earn in a given month, how much savings you made as well as any other financial obligations if any. By doing this evaluation, you will be able to pinpoint the exact amount of the deductible which can be reasonably set aside from emergency medical care.

Age and Health Considerations

The correct level of deductible for your chosen super Visa Insurance Monthly plan can depend heavily on age as well as having pre-existing health conditions. The advanced age of individuals raises the chances of their needing medical attention, making a lower deductible very attractive. In addition to this, those with pre-existing conditions could benefit from a lower deductible as high charges involved here can be avoided.

Travel Frequency and Duration

If your dear ones plan to go on frequent travelling or stay in Canada for extended times, you are advised to choose low deductibles. This kind of approach provides them security and financial protection in case any sudden health issues arise during such visits. On the other hand, if these trips are rare or short-term then higher deductibles would be more economical.

Comparing Plans and Providers

Given that there are many insurance companies providing super visa insurance monthly payment plans, it is important that you compare deductible options as well as limits of cover provided in various policies. In order for you to make sure that your decision has been made wisely enough so as to mandate specific requirements, seek help from professional insurers or any other trusted advisors.

Striking the Right Balance

In essence, choosing the correct deductible for a person’s super visa insurance monthly plan requires him/her to strike a balance between affordability and sufficiency; this should happen when putting into consideration their risk tolerance level, financial capabilities and how much they would pay in terms of direct medical costs out-of-pocket. By taking into account these things properly, one can get to that appropriate point which promises tranquillity/security and sound finance management.

Additional Considerations

There are other factors besides just looking at the premium charged per month that one needs to consider when selecting his/her deductible for a super visa insurance monthly plan. Evaluate the age of your loved ones, whether they have preexisting health conditions and how frequently they tend to go on trips or how long they last. These factors can significantly impact the suitable choice of the deductible before comprehensive coverage is tailored specifically for them.

Seeking Professional Advice

The world of insurance is complex and getting professional advice can be important when it comes to super visa monthly payment insurance which requires an expert. Insurance brokers, financial advisors, or healthcare professionals with expertise in these kinds of monthly plans for super visa insurance should be consulted.

Revisiting and Adjusting

It is necessary to review your super visa insurance monthly plan and make adjustments as needed with changing circumstances. Such life changes as health condition fluctuations, a different financial state or travelling habits could imply an evaluation of your deductible option. Always act ahead by reviewing the plan on a regular basis so that it fulfils your needs and gives you the right coverage for you.

Family Support Network

When considering the financial aspect, it is also essential to assess what support system will be available to your loved ones while they are in Canada. Good family friend network can assist in navigating the medical care system, attending medical appointments with them and being there emotionally during difficult occasions. In some cases, this help offers some relief from heavy burdens that come with higher deductibles making one able to manage out-of-pocket costs.

Emergency Fund Considerations

While determining the right deductible for your super visa insurance monthly plan, it is critical to think about establishing an emergency fund. In case of any unexpected medical emergencies, this fund works as a fiscal safety net hence enabling you cover higher deductibles. This way you will be able to deal effectively with possible out-of-pocket costs associated with higher-deductible plans for monthly payment super visa insurance.

Conclusion

Choosing an appropriate deductible amount for your super visa insurance monthly plan involves balancing various factors that require careful consideration. By understanding how premiums relate to deductibles; assessing personal finances; taking into consideration age and health; evaluating travel frequency and duration, you will be able to make an informed choice which strikes a balance between affordability and comprehensive coverage.

It is important to keep in mind that the quest for the best Super Visa insurance monthly plan is ongoing. Embrace change, seek professional advice when needed, and stay proactive in revisiting and adjusting your plan to ensure it continues to serve your evolving needs effectively.

Parents Super Visa

Super Visa insurance ensures visiting parents and grandparents are covered for unexpected medical emergencies during their stay in Canada. To help you effectively deal with these emergencies, working with a leading Super Visa insurance company, for example, Parent Super Visa, is truly a smart idea. Rest assured that choosing Parent Super Visa will lead to the best value Super Visa insurance policy, to your delight and satisfaction. Simply put, the company is armed with qualified and fully dedicated insurance experts who will walk the extra mile to provide the best possible and affordable Super Visa solutions that will effectively cater to the emerging healthcare needs of Canadians. Visit https://parentsupervisa.ca to learn more about and/or hire the Super Visa Insurance services it offers.