Choosing insurance for parents or grandparents visiting Canada can feel overwhelming, especially when every provider claims to offer the “best” plan. In 2026, rising healthcare costs, evolving immigration rules, and varied policy structures make it even more important to look beyond marketing promises. Real value is not about the lowest price; it is about protection that actually works when needed. Families who understand how to evaluate coverage carefully are far more likely to select the best Super Visa Insurance that delivers peace of mind rather than surprises.

Understanding What “Value” Truly Means in Super Visa Insurance

Many people equate value with affordability, but in Super Visa insurance, value is a balance between cost, coverage, reliability, and transparency. A low premium can seem attractive until exclusions, high deductibles, or limited benefits come into play. True value lies in how well a policy responds during a medical emergency in Canada’s expensive healthcare system.

The best Super Visa Insurance focuses on real-life medical needs, including hospital stays, emergency treatments, and follow-up care. When evaluating plans, families should ask whether the coverage would still feel worthwhile if a claim actually occurs.

Coverage Limits Matter More Than Premiums

One of the most overlooked factors when comparing plans is the overall coverage limit. While meeting the minimum visa requirement is mandatory, it may not be sufficient in practice. A single hospital visit in Canada can exceed basic coverage limits within days.

High-value insurance options offer coverage amounts that reflect modern healthcare realities. When reviewing policies, look for plans that provide robust emergency medical coverage without overly restrictive caps. This is a defining feature of the best Super Visa Insurance, as it protects families from financial strain during serious medical events.

Clear Pre-Existing Condition Terms Are Essential

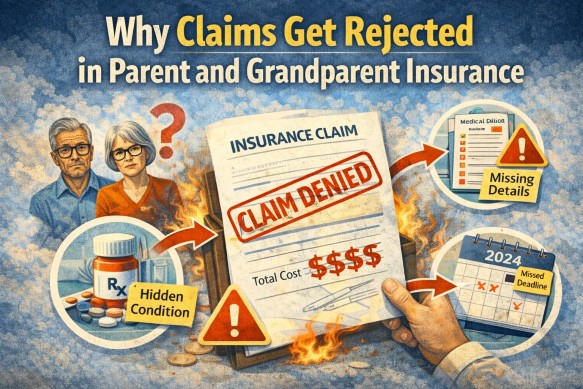

Pre-existing conditions are a reality for many parents and grandparents. Unfortunately, they are also one of the most common reasons for denied claims. Real value comes from policies that explain stability requirements clearly and fairly, rather than burying conditions in fine print.

Families should carefully review how “stable” is defined and how long the stability period lasts. Insurance that provides transparent pre-existing condition coverage, with clearly stated terms, is far more valuable than a cheaper plan that offers vague or restrictive definitions.

Deductibles Can Change the True Cost of Coverage

Deductibles significantly influence both premiums and out-of-pocket expenses. Some plans reduce costs by offering high deductibles, which may not be ideal for families on fixed budgets. Others allow flexible deductible choices, letting families balance affordability with financial security.

When evaluating value, consider how much you would realistically pay during an emergency. The best Super Visa Insurance offers deductible options that are clearly explained, allowing families to choose a level that suits their financial comfort without unpleasant surprises later.

Policy Transparency and Readability Are Key Indicators

A strong indicator of real value is how easy a policy is to understand. Insurance documents should explain benefits, exclusions, and claims processes in plain language. If a policy feels intentionally complicated, that is often a warning sign.

High-quality Super Visa insurance providers prioritize transparency, ensuring customers understand what is covered and what is not. This clarity builds trust and reduces stress when claims are required. Policies that are straightforward and well-documented often outperform cheaper, confusing alternatives.

Claims Process Efficiency Defines Real-World Value

Insurance only proves its worth when a claim is made. Delayed responses, complex documentation requirements, and poor customer support can turn an already stressful medical situation into a frustrating experience.

The best Super Visa Insurance stands out by offering streamlined claims processes, responsive support, and clear guidance for families during emergencies. When comparing plans, consider how claims are handled, how quickly reimbursements are processed, and whether assistance is available when it matters most.

Flexibility for Length of Stay and Renewals

Parents visiting Canada often stay for extended periods or make multiple visits over several years. Insurance that lacks flexibility for renewals or longer stays can quickly lose value. Some plans require new medical underwriting at renewal, while others allow seamless extensions.

Policies designed with long-term visits in mind offer better overall value. They reduce administrative hassle and provide continuity of coverage, which is especially important for older travellers.

Trusted Providers Make a Meaningful Difference

Insurance is not just a product; it is also a service. Working with a provider that understands Super Visa requirements and Canadian healthcare systems adds significant value. Trusted providers guide families through plan selection, explain policy details, and provide ongoing support.

The best Super Visa Insurance is often associated with providers who prioritize customer education, regulatory compliance, and ethical practices. Their expertise helps families avoid costly mistakes and ensures coverage aligns with both visa rules and personal needs.

Making a Confident Choice in 2026

Spotting real value in Super Visa insurance requires careful comparison, thoughtful questions, and a focus on long-term protection rather than short-term savings. When coverage is comprehensive, transparent, and backed by reliable support, families can feel confident they have made the right decision.

Parent Super Visa Insurance Company is dedicated to helping families identify genuine value, not just attractive pricing. Speak with our experienced advisors today to compare options, understand coverage details, and secure protection that truly supports your parents throughout their stay in Canada.